Wednesday, May 30, 2012

Carr Banking on TTU

Angelo State University's Carr Foundation shifted investments to Texas Tech's Long Term Investment Fund (LTIF) during 2008, a precarious time for most asset classes, but a particularly rough spell for alternative investments. Texas Tech documents show $56 million of Carr money shifting to the LTIF between May 2008 and February 2009.

The chart above shows LTIF returns for 2008 at -21.7% (green bar). Returns bounced back in 2009 and 2010 to 17.7% (purple bar) and 13.1% (aqua bar). The three year return is 4.23% or 1.4% per year.

It's difficult to know how much Carr made or lost during this time, given the varied information from differing data sources. Carr Foundation 990 IRS filings show $39 million invested in LTIF in 2007, which rose to $71 million in 2008.

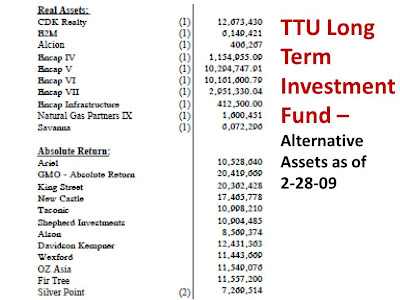

LTIF's percent return data shown does not include private equity or real estate assets. Yet, those alternative assets are a substantial part of the portfolio.

For those interested in the fund's detailed alternative investments, see below:

Click on any image to make it bigger.

The LTIF has two Goldman Sachs private equity investments. The Shannon Trust had nearly $10 million in Goldman Sachs Structured Products, which it wrote down heavily. Goldman settled with investors for over $1 billion. Did The Shannon Trust or TTU's LTIF get any Goldman settlement proceeds? One Trustee might know, given they serve on both the Shannon and Carr Estate Foundations.

Live to Tell

Per the request of the commenter, my post titled "Carr Foundation: No Change = Massive Change" has been taken down.

It is difficult for people under poor leaders to tell their story. Speaking stories of abuse garners more abuse. That's solely my observation, no one else's.

Tuesday, May 29, 2012

Rallo Replacement Committee Driven by Carr Trustee

The committee to replace Angelo State University President Dr. Joe Rallo has been named.

It essentially exists of two Carr Foundation Trustees (one of which is chairing the Search Committee), two area executives (one of which doubles as San Angelo's Mayor) and two ASU faculty leaders (one formal, the other informal).

Dr. Rallo and new Carr Trustees changed nearly everything about Carr, despite assertions to the contrary in 2007. An evolving foundation needs a new ASU President to drive policy.

Dr. Rallo will concentrate on veterans’ issues, distance learning and international programs at TTU, as well as provide the face for academic affairs system-wide.

“Angelo State is an evolving university, and we are determined to find the best leader who will continue the institution’s tradition of excellence and vision for the future.”

It essentially exists of two Carr Foundation Trustees (one of which is chairing the Search Committee), two area executives (one of which doubles as San Angelo's Mayor) and two ASU faculty leaders (one formal, the other informal).

Dr. Rallo and new Carr Trustees changed nearly everything about Carr, despite assertions to the contrary in 2007. An evolving foundation needs a new ASU President to drive policy.

The final selection will be made by the chancellor, who will seek confirmation of his choice by the Board of Regents.Early reports had Rallo working to find his replacement. That fact didn't make this press release. Also, there was no mention of the consulting firm assisting with the search.

Dr. Rallo will concentrate on veterans’ issues, distance learning and international programs at TTU, as well as provide the face for academic affairs system-wide.

MedHab's Newsworthy 2012 Yields No News

One might expect a fledgling medical device company to link to the series of stories run in West Texas newspapers in 2012, but MedHab stoically refuses to update their news/press releases page.:

Also, MedHab could have linked to the economic development package offered by San Angelo Development Corporation. One might expect a $3.6 million package to be newsworthy Lastly, ASU magazine did a story on MedHab founder Johnny Ross, which was picked up by several web news aggregators.

Yet, MedHab's website shows its latest news as of June 2011. For a year with such news, it's odd there's no news.

San Angelo Standard Times - 2 stories

Abilene Reporter News - 2 stories

Lubbock Avalanche Journal - 4 stories - referenced here and here

Also, MedHab could have linked to the economic development package offered by San Angelo Development Corporation. One might expect a $3.6 million package to be newsworthy Lastly, ASU magazine did a story on MedHab founder Johnny Ross, which was picked up by several web news aggregators.

Yet, MedHab's website shows its latest news as of June 2011. For a year with such news, it's odd there's no news.

Thursday, May 24, 2012

TTU & ASU's Carr Dischord

One might expect Angelo State and Texas Tech Annual Financial Reports to be in harmony on The Carr Foundation after the two universities merged in 2007. They start out aligned. Both show Vaughan Nelson and Fountain Capital as investment managers.

That picture diverges in 2008 and beyond: The timing of ASU's shift from Vaughan Nelson & Fountain Capital as investment managers to Texas Tech's Long Term Investment Fund (LTIF) is noteworthy.

Texas Tech documents show the shift nearly complete in early 2009, while Angelo State reports don't mention the move until 2011. Note who ASU wants to take the blame for two years of investment losses. It's not Texas Tech.

An apparent insider (critical of my series of posts) offered

The transition of the funds (to TTU's LTIF) began in 2007 and was finalized some 15 months later.A university audit from February 2008 indicated changes were in store:

Who was ASU's Manager of Scholarship Programs? Were they eliminated per the audit suggestion?

For those who like to check for themselves:

ASU FY07

ASU FY08

ASU FY 09

ASU FY10

ASU FY11

TTU Managed Investments 11-07

TTU Managed Investments 2-08

TTU Managed Investments 5-08

TTU Managed Investments 2-09

TTU Managed Investments 2-10 & 2-11

Also, why did TTU report Carr as miniscule in early 2011? ASU's website states the Trust has over $96 million. That's a big typo...

Monday, May 21, 2012

TTU Regents' Agenda: ASU Program Deletions

On the consent agenda last Friday:

Dr. Rallo's achievements during his tenure as ASU President need amendment.

If the TTU Board of Regents approved the consent agenda, ASU's medical technologist program will be gone, as will its Masters in Nursing - Clinical Specialist. and the Masters of Public Administration. I thought ASU's Health Programs were "of distinction" and the Graduate School a huge factor in ASU's growth.

The following information exaggerated ASU's success by roughly 1,000 students.

Why the proposed moves? What did the Board of Regents decide and when will ASU faculty find out? Will it be in the newspaper like Dr. Rallo's promotion?

Click on the image to view it larger

Dr. Rallo's achievements during his tenure as ASU President need amendment.

Angelo State now offers about 50 degrees, 10 more than before the realignment, Rallo said.

If the TTU Board of Regents approved the consent agenda, ASU's medical technologist program will be gone, as will its Masters in Nursing - Clinical Specialist. and the Masters of Public Administration. I thought ASU's Health Programs were "of distinction" and the Graduate School a huge factor in ASU's growth.

The following information exaggerated ASU's success by roughly 1,000 students.

Since the merger became official Sept. 1, 2007, student enrollment has grown from 7,083 to about 8,000, a 13-percent increase.

Why the proposed moves? What did the Board of Regents decide and when will ASU faculty find out? Will it be in the newspaper like Dr. Rallo's promotion?

Click on the image to view it larger

Sunday, May 20, 2012

Did Carr Save Tech's LTIF Pool?

After researching the movement of Angelo State University Carr Trust funds into Texas Tech's Long Term Investment Fund (LTIF), a thought struck me. Was Carr cash a timely capital injection for Tech's LTIF during the Fall 2008 Financial Crisis?

The Texas Tech Foundation offered in its 2009 Annual Financial Report:

The Texas Tech Foundation experienced a $42.9 million loss in 2008. Angelo State's Carr Foundation lost a mere $2.9 million when it sold securities with a cost basis of $34 million for $31 million.

Carr invested $39 million in Tech's LTIF in 2007. That grew to $71 million in 2008. The question is when Carr's additional $32 million hit Tech's LTIF? If it came in the midst of the financial meltdown, Carr's cash could've been a stabilizer for an investment pool holding derivatives and mortgage backed security obligations.

Depending on the directional bets, such a portfolio could've faced a deluge of capital calls. Below is the foundation's international currency exposure.

Did Carr money help Tech's risky investment pool during the financial crisis? That'd make a good business school case.

Click on any of the images to view them larger

The Texas Tech Foundation offered in its 2009 Annual Financial Report:

The majority of Texas Tech University System assets are invested in two investment pools; the Long Term Investment Fund (LTIF) and the Short/Intermediate Term Investment Fund (STIF). Endowment funds and certain eligible long-term institutional funds are invested in the LTIF, which invests in equity and fixed income securities and is operated using total return philosophy.As there are no public documents showing the LTIF's performance during the meltdown, hints must be found elsewhere, i.e. in the foundations the LTIF serves..

The LTIF has experienced varying performance since its inception.

The Robert G. and Nona K. Carr Foundation was established for the benefit of Angelo State University. The Foundation is included in the Texas Tech University System financial statements as a blended component unit.

The Texas Tech Foundation experienced a $42.9 million loss in 2008. Angelo State's Carr Foundation lost a mere $2.9 million when it sold securities with a cost basis of $34 million for $31 million.

Carr invested $39 million in Tech's LTIF in 2007. That grew to $71 million in 2008. The question is when Carr's additional $32 million hit Tech's LTIF? If it came in the midst of the financial meltdown, Carr's cash could've been a stabilizer for an investment pool holding derivatives and mortgage backed security obligations.

Depending on the directional bets, such a portfolio could've faced a deluge of capital calls. Below is the foundation's international currency exposure.

Did Carr money help Tech's risky investment pool during the financial crisis? That'd make a good business school case.

Click on any of the images to view them larger

Saturday, May 19, 2012

Texas Tech's HemoBioTech

Searching for Texas Tech on Edgar, the SEC's online databese, I came across HemoBioTech. Filings indicated Texas Tech owned over 800,000 shares, amounting to 5.8% of the company. HemoBioTech was in the business of providing human blood substitutes.

Once the cash was drained from HemoBioTech, it ceased filing SEC reports. None were filed in 2011 and 2012.

One investor bet big on the firm in 2010. He was:

I hope the book came out before HemoBioTechs' breakdown.I'm sure this is the exception to Texas Tech's investing prowess. It was the only story available through the SEC. Count it as a one off.

Once the cash was drained from HemoBioTech, it ceased filing SEC reports. None were filed in 2011 and 2012.

One investor bet big on the firm in 2010. He was:

The author of a new soon to be released investment book, "Finding Midas" "The Way to Mega Stock Gains."

I hope the book came out before HemoBioTechs' breakdown.I'm sure this is the exception to Texas Tech's investing prowess. It was the only story available through the SEC. Count it as a one off.

Carr Trust Invests Almost Exclusively with TTU

Carr Foundation IRS filings showed a growing relationship between the Carr Trust and Texas Tech's Long Term Investment Fund after Dr. Joe Rallo arrived as President and Angelo State University joined the Texas Tech System. By 2011 the Carr Trust invested 98.9% of its corpus with Tech's Long Term Investment Fund (LTIF).

A May 2011 report on Texas Tech's managed investments had a footnote for Carr:

That means Texas Tech's LTIF is the sole investor for ASU's Carr Foundation.

Oddly, Texas Tech's Long Term Investment Fund is not listed as a nonprofit under Guidestar, nor does it file with the Securities and Exchange Commission (SEC) as an investment manager. It appears to be a private investment fund.

In late 2011 Tech's Long Term Investment Fund changed its asset allocation, shifting more resources to Private Real Assets. That the subject for another post

A May 2011 report on Texas Tech's managed investments had a footnote for Carr:

Any non-LTIF balance for Carr is just cash that is either moved to the LTIF or remitted to ASU after this report date.

That means Texas Tech's LTIF is the sole investor for ASU's Carr Foundation.

Oddly, Texas Tech's Long Term Investment Fund is not listed as a nonprofit under Guidestar, nor does it file with the Securities and Exchange Commission (SEC) as an investment manager. It appears to be a private investment fund.

In late 2011 Tech's Long Term Investment Fund changed its asset allocation, shifting more resources to Private Real Assets. That the subject for another post

ASU Shifted Carr Money to TTU Under Rallo

Texas Tech President Kent Hance won't leave office until he's raised $1 billion for TTU. How much did Angelo State University (ASU) President Dr. Joe Rallo help Hance's effort by "investing" Carr Foundation funds in Texas Tech's Long Term Investment Fund?

ASU's website states:

The Carr Foundation assets currently surpass $96 million, and the interest from the principal helps support a number of scholarship programs at ASU.The picture below shows Carr's increased investment in TTU's Long Term Investment Fund, beginning in 2007. This information is from 2008-2010 Carr Foundation 990 filings with the IRS (source: Guidestar).

The oil and gas income does not fund scholarships directly. The money earned from oil and gas royalties is collected and then invested into the Texas Tech University System Long Term Fund. The interest earned off these financial investments is accumulated to fund scholarships.

Dr. Rallo arrived as Texas Tech and ASU consummated the merger. The Carr Foundation's 2007 990 filing shows $39 million invested in TTU's Long Term Investment Fund. That rose to $71 million in 2008 and an implied $79 million in 2009.

As for the safety of Carr investments, TTU documents paint Carr as a staid investor. TTU's Long Term Investment Fund is more the dice roller, with over 57% in risky alternative investments.

Carr is shown as a heavy TexPool investor (80% of funds), with the other 20% in Mineral Rights. .This isn't the least bit accurate given Carr's heavy investment in TTU's Long Term Investment Fund.

In 2008 over half of Carr money was effectively invested in alternative assets, the green pie wedge above.

As Dr. Rallo moves on to the Vice Chancellor of Academic Affairs for the Texas Tech University System, his accomplishments have been recognized.

Friday, May 18, 2012

Rallo to Be VC-Academic Affairs at TTU

The Standard Times reported:

ASU's press release added:

Dr. Rallo's silence and compliance during the 2011 Legislative Session paid off with a promotion. Tim Hudson, the most recent occupant of the Vice Chancellor position was in the role less than a year. Ironically, Hudson became Chancellor at a different ASU, Arkansas State University.

Does system-level strategic planning mean Rallo will keep his mitts on San Angelo's ASU? Will he call the shots on ASU's accreditation, academic policies, international affairs, distance and online education?

Dr. Rallo will have a hand in selecting his successor:

Angelo State University President Joseph Rallo has been named vice chancellor for academic affairs with the Texas Tech University System. The Board of Regents approved his appointment today. Rallo will begin his duties effective upon the naming of a replacement at Angelo State.

ASU's press release added:

Rallo will oversee system-level strategic planning and help manage the academic profile for each of the system’s component institutions, handling initiatives such as accreditation, academic policies and programs, international affairs and distance education, and online learning. He also will coordinate efforts at the system’s multiple campuses and academic sites, as well as system expansion.Dr. Rallo's accreditation record at ASU is anything but stellar. His vision for online learning and distance education involved professors teaching 1,600 students per class. His strategic planning skills were suspect in his elimination of the Honors Program and ASU's "no layoff" layoff.

Dr. Rallo's silence and compliance during the 2011 Legislative Session paid off with a promotion. Tim Hudson, the most recent occupant of the Vice Chancellor position was in the role less than a year. Ironically, Hudson became Chancellor at a different ASU, Arkansas State University.

Does system-level strategic planning mean Rallo will keep his mitts on San Angelo's ASU? Will he call the shots on ASU's accreditation, academic policies, international affairs, distance and online education?

Dr. Rallo will have a hand in selecting his successor:

The TTU Board of Regents, Rallo and Hance will develop a search process for Angelo State’s sixth president.Rallo is in a position to strongly influence the selection of ASU's next President. Will Rallo's sudden move impact Brian May's expected rise to the top? Much remains to be seen.

Thursday, May 17, 2012

City to Spend over $330,000 to Push Out Nasworthy Walkers

The San Angelo Standard Times reported on City Council's move to take public use areas of Lake Nasworthy and commercialize them, a move predicted by Bill Cullins two years ago..

The irony is local taxpayers could pay to have their access to the lake reduced or eliminated.

Council members voted to go forward with negotiations with Gateway Planning Group to develop the Lake Nasworthy area, essentially approving the spending of about $300,000 on a business plan.... The city is looking for firms with experience in tourism and recreational value.The theme is not keeping local citizens access to free recreation at the lake. Gun Club Road walkers are referred to as a "conflict":

Another focus is on finding a firm that can help bring development to the lake instead of merely advising how that can be done, she said.....the theme was "linking neighborhoods and tourism."

"...resolving conflicts such as having joggers on roads near the lake, and dealing with "sacred cows" such as businesses that are already there that might be threatened."The City's downtown development plan repeated talked of the gap between project costs and project profitability required by developers. Public money, public assets, tax breaks, direct subsidy are all means to shrink that gap.

The irony is local taxpayers could pay to have their access to the lake reduced or eliminated.

(Mayor) New told council members that getting city staff to go forward with negotiations would be tantamount to spending the money for the plan, although it will need to come back to the City Council for approval.That sounds tantamount to a railroad, at least to my ears. Adding 11-12% expense reimbursement takes the cost to $330,000 to $336,000. To think it's already been spent...

Sunday, May 13, 2012

City Council to Consider Holmes Murphy, Ethicon Proposals

San Angelo City Council will consider numerous proposals, ranging from Ethicon to area lakes, from the airport to health insurance benefit consultant Holmes Murphy.

The first regards an economic development designation for Ethicon such that it can pursue state funds. Council approved two different incentives for Ethicon over a year ago. The first was a $572,000 tax rebate and the second a $300,000 incentive to keep 30 jobs.

Another agenda item relates to the City's health insurance benefit for employees, retirees and dependents. The City saved $480,000 by executing an exclusive contract with San Angelo Community Medical Center.

The Airport and Lake Nasworthy are the key to making San Angelo a bigger draw. Budget revisions show $500,000 to recruit a new airline to town.

The City is ready to hire a Master Planner for Lake Nasworthy. The group selected has extensive experience with market opportunities and public-private strategies, i.e commercializing waterside properties. Other highlights include:

The first regards an economic development designation for Ethicon such that it can pursue state funds. Council approved two different incentives for Ethicon over a year ago. The first was a $572,000 tax rebate and the second a $300,000 incentive to keep 30 jobs.

At its meeting of August 3, 2010, Council approved a resolution nominating Ethicon as an Enterprise Project. The company subsequently applied to the Office of the Governor and was denied. The company is requesting that the City of San Angelo again nominate Ethicon as an Enterprise project. This will allow the company to gain State Sales Tax and Franchise Tax abatements on the new machinery and equipment. In addition, the company will be eligible to participate in the State Tax Credit Program for Job Creation and Retention. The deadline for application to the State is September 1, 2012. Ethicon currently anticipates making a capital investment of between $12 million and $28 million in updated plant equipment.Council will likely give Ethicon the designation such that it can reapply for Texas taxpayer money.

Another agenda item relates to the City's health insurance benefit for employees, retirees and dependents. The City saved $480,000 by executing an exclusive contract with San Angelo Community Medical Center.

ACAP will work solely with SACMC providers on Clinical Care Engineering. I look forward to seeing what comes back to council from such negotiations. Maybe ACAP can help the City of San Angelo revise its current budget to reflect Council's decision under Phase ! of health insurance. So far, no city staffers have gotten the job done.Seeking approval from Council to negotiate a contract with ACAP Health, an affiliate company of Holmes-Murphy & Associates, to provide Clinical Care Engineering (CCE) services for the health insurance program. The contract would exist as an addendum to the existing Holmes-Murphy & Associates contract.

History: During the health insurance negotiations during the summer of 2011, Holmes-Murphy utilized their affiliate company, ACAP Health, to assist with the complex discussions. ACAP Health was very instrumental in analyzing data used in calculating the health care benefits and costs. Last year’s negotiations with providers should be considered as Phase I in the continuing efforts to provide effective health insurance benefits. Phase II of the ACAP Health services will be to work directly with the providers to attain high value, accountable care for plan participants. This direct relationship will provide the City with a better understanding of the quality performance of the providers and of the cost of the clinical care being rendered. Evidence has shown that higher quality health care actually costs less when the right processes are in place to avoid the unnecessary waste and the complications inherent in a fragmented care continuum.Financial Impact: The cost is to be negotiated as part of the contract. The savings will be measured based on actual claims

The Airport and Lake Nasworthy are the key to making San Angelo a bigger draw. Budget revisions show $500,000 to recruit a new airline to town.

The City is ready to hire a Master Planner for Lake Nasworthy. The group selected has extensive experience with market opportunities and public-private strategies, i.e commercializing waterside properties. Other highlights include:

The Twin Buttes pumping station, priced at $327,000, is a budget amendment.San Angelo is on the move.

City Hall renovation rose another $275,000 and is now $12.6 million.

Saturday, May 12, 2012

Critical City Council Decision Yet to Make it into Revised 2012 Budget

Six months seems a long time to wait for budget numbers for a San Angelo's City Council decision made in November 2011. Council approved Aetna as its health insurance provider at a projected annual savings of $480,000 under an exclusive provider arrangement with San Angelo Community Medical Center. My initial request stated: .

City Human Resources Director Marley responded that same day:

Given the trajectory, which health insurance budget number will come out first, revised 2012 or draft 2013? Recall the State Comptroller's Office awarded the city a silver medal for transparency.

Update 12-17-12: The City stuck to their original budget guns, a year after making a $500,000 change and approving a last minute budget amendment Incompetence or mendacity?

Thursday, November 17, 2011 1:25:25 PM CST - When does HR Director Lisa Marley think she'll have the updated health insurance numbers for 2011-2012 (based on council's recent decisions)?

City Human Resources Director Marley responded that same day:

Thursday, November 17, 2011 4:45 PM - Adjusting the budget due to the Council’s Tuesday decisions will be handled during the budget mid-year presentation to Council. Finance generally does that around March of each year.After waiting patiently, and then some, I dusted off my request and sent it to the City's Public Information Office:

Saturday, April 14, 2012 1:18 PM - As it's April I'd like the revised budget numbers for health insurance from the budget mid year assessmentThe City's reply came within a week:

I waited two more weeks to ask for the third time:Friday, Apr 20 03:17 PM - Our budget office said there has been no revised budget numbers for health insurance yet. I’m checking to see when or if there will be one.

Saturday, May 5 11:39 AM - Are there any new budget numbers based on Council's decision last fall?The echo continued

Monday, May 7 07:55 AM - No new budget numbers at this point. I'll see if I can get information on when our budget office will have new numbers. :The situation struck me as odd, so I wrote back:

Monday, May 7 09:12 PM - I remain confused as to how the city operates if a City Council decision made in November isn't translated into budget numbers for management to use.It got odder with the city's reply:

I may have been less than charitable in my reply.:Wednesday, May 9 09:08 PM - I'll let you know what I find out from our budget office. They have been busy preparing expense budgets for next year.

Wednesday, May 9 10:00 PM - That's what makes the health insurance thing so strange. Expense budgets for the coming year are usually based on revised budgets, i.e. the most current numbers/thinking.

It became clear to me the city wasn't interested in sharing the true picture when HR Director Lisa Marley stated they didn't have numbers for health insurance plan years (calendar) and only had fiscal year. Of course, the City has plan year information. That's the way the health insurance company keeps the city's data.

Given the trajectory, which health insurance budget number will come out first, revised 2012 or draft 2013? Recall the State Comptroller's Office awarded the city a silver medal for transparency.

Update 12-17-12: The City stuck to their original budget guns, a year after making a $500,000 change and approving a last minute budget amendment Incompetence or mendacity?

Wednesday, May 09, 2012

News on ASU & MedHab

The first MedHab news in four months came courtesy of Angelo State University. The story focused on ASU's computer science department. It stated:

I'm curious how Acquire Media News Edge landed this story. It's not from an ASU news release or a Standard Times story, at least it didn't come up in searches on their sites.

Regardless of source motivation, MedHab must produce product for FDA trials and the anticipated fall product launch. One might expect them to announce the selection of a production site.

Update 5-12-12: ASU Magazine produced the story, which Acquire Media News Edge scraped. My question is answered.

Update 5-15-12: Texas legislators may provide seed funding for the MedHab's of the world.

Another company, Fort Worth tech startup MedHab, approached Roden in October of 2011. Their discussions led to MedHab giving ASU a $90,000 grant to develop software, including mobile apps, for a newly-patented wearable medical device called StepRight. The product is designed for people with leg injuries, and automates much of their physical therapy using sensors that send data in real time to cloud-based servers. The system also makes use of mobile phones to transfer data to caregivers in case a patient is not at home or near a computer. Roden is the principal investigator on the project supervising several ASU students and recent graduates.This piece shows MedHab approached ASU a mere three months before San Angelo's City Council awarded $3.6 million in incentives for MedHab's production site. That's a new element in the MedHab timeline. MedHab has San Angelo's Mayor Alvin New on its board of directors and ASU Physical Therapy Professor Scott Hasson as an advisor.

“The product is due for FDA trials this summer and should enter the marketplace this fall,” Roden said.

I'm curious how Acquire Media News Edge landed this story. It's not from an ASU news release or a Standard Times story, at least it didn't come up in searches on their sites.

Regardless of source motivation, MedHab must produce product for FDA trials and the anticipated fall product launch. One might expect them to announce the selection of a production site.

Update 5-12-12: ASU Magazine produced the story, which Acquire Media News Edge scraped. My question is answered.

Update 5-15-12: Texas legislators may provide seed funding for the MedHab's of the world.

Saturday, May 05, 2012

Texas Tribune & ASU Salary Database

The Texas Tribune hosts a government agency salary database. One area citizen queried when the Tribune might add Angelo State University salaries to their online database. This inquiry began in February.

The February time frame is interesting as that's when Texas Tech was due to update their annual salary information.

Gypsy followed up in late April.

There's been no reply to her May 1 inquiry. Interestingly, while Texas Tech has the oldest university data set with the Tribune, Texas State University System's is the freshest.

ASU left the Texas State University System as Dr. Joe Rallo became President. Representative Drew Darby orchestrated the move back in 2007. Interestingly, the Texas Tribune recently hosted a "Hot Seat" Forum at ASU with Drew Darby and Senator Robert Duncan.

With the "Hot Seat" over, maybe the Tribune can get TTU to update their salary information and get Angelo State's added. Until then, citizens will rely on The Standard Times data set. It's due for an update next month.

I, for one, appreciate San Angelo's interested citizens' brigade. Keep asking the questions, even when answers are few and far between.

Update 10-20-12: Texas Tribune updated Angelo State's salary information. Their updated database lists 736 names/salaries. ASU's website lists 1,635 employees. Texas Tribune's database is 899 people short.

Subscribe to:

Comments (Atom)