Wednesday, May 30, 2012

Carr Banking on TTU

Angelo State University's Carr Foundation shifted investments to Texas Tech's Long Term Investment Fund (LTIF) during 2008, a precarious time for most asset classes, but a particularly rough spell for alternative investments. Texas Tech documents show $56 million of Carr money shifting to the LTIF between May 2008 and February 2009.

The chart above shows LTIF returns for 2008 at -21.7% (green bar). Returns bounced back in 2009 and 2010 to 17.7% (purple bar) and 13.1% (aqua bar). The three year return is 4.23% or 1.4% per year.

It's difficult to know how much Carr made or lost during this time, given the varied information from differing data sources. Carr Foundation 990 IRS filings show $39 million invested in LTIF in 2007, which rose to $71 million in 2008.

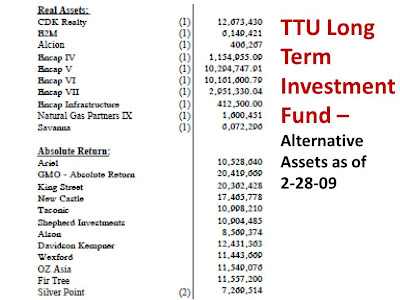

LTIF's percent return data shown does not include private equity or real estate assets. Yet, those alternative assets are a substantial part of the portfolio.

For those interested in the fund's detailed alternative investments, see below:

Click on any image to make it bigger.

The LTIF has two Goldman Sachs private equity investments. The Shannon Trust had nearly $10 million in Goldman Sachs Structured Products, which it wrote down heavily. Goldman settled with investors for over $1 billion. Did The Shannon Trust or TTU's LTIF get any Goldman settlement proceeds? One Trustee might know, given they serve on both the Shannon and Carr Estate Foundations.

Subscribe to:

Post Comments (Atom)

No comments:

Post a Comment